Homeowners Endorsements

🏠 The Home Insurance Extras Every Metairie Homeowner Should Know About

Easy-to-understand stories to help protect what matters most.

Living in Metairie means sunshine, seafood, and the Saints—but it also means you’ve got to be smart about protecting your home. A basic homeowners insurance policy is a great start, but it doesn’t cover everything. That’s where endorsements come in—think of them like bonus features that fill in the gaps.

Let’s talk about the most important endorsements you should not overlook.

💎 1. Personal Property Endorsement (a must for jewelry & collectibles)

Your standard policy usually only covers about $1,500 for things like jewelry. So, if you’ve got a diamond ring, designer handbag, or rare coin collection, you’ll need this endorsement.

Story: Marie inherited her grandma’s antique necklace. She thought it was fully covered—until she learned her policy capped jewelry at $1,500. With an endorsement, she got it appraised and covered for the full $8,000.

🧯 2. Equipment Breakdown Endorsement

If your AC unit, refrigerator, or washing machine breaks down due to an electrical issue or mechanical failure—not normal wear and tear—a standard policy doesn’t help. This endorsement fills that gap.

Story: When the Boudreaux family’s central AC suddenly stopped during a heatwave, this endorsement covered the repairs. Without it, they’d be sweating and shelling out $4,000.

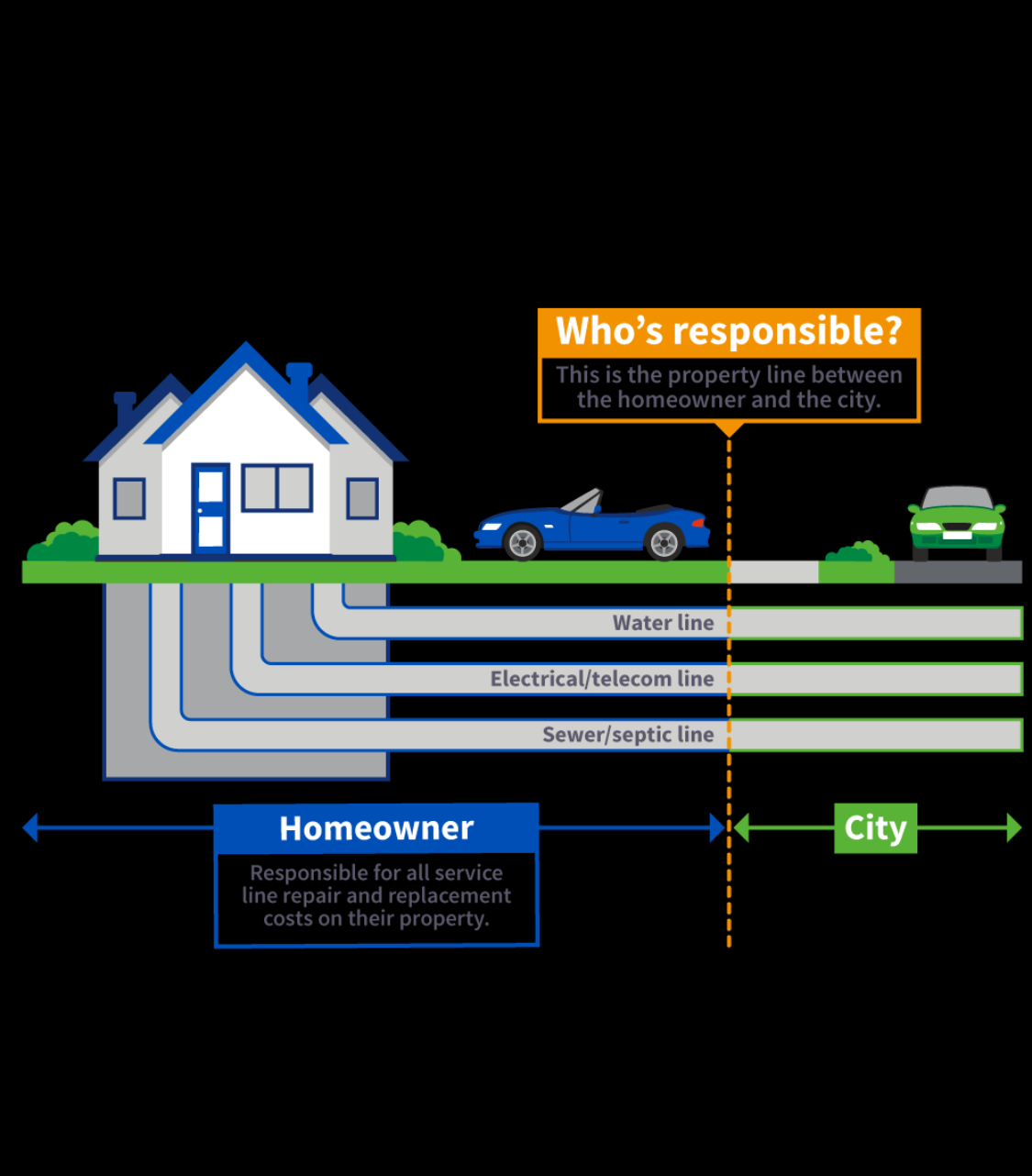

🔌 3. Service Line Endorsement

If your water, sewer, or electrical lines (the ones running from the street to your house) are damaged, you’re responsible—but your basic policy doesn’t cover it.

Story: Mr. Thibodeaux’s water line cracked under the driveway. The repairs cost over $5,000. Thankfully, his service line endorsement covered digging, repairs, and the concrete replacement.

❄️ 4. Refrigerator Contents – Hurricane Endorsement

In Louisiana, power outages during hurricanes are common. When the fridge goes out, so does all your food—and that’s not covered unless you have this special endorsement.

Story: After Hurricane Ida, the Duponts lost hundreds of dollars in food. But with this endorsement, their policy reimbursed them for all the spoiled groceries.

💧 5. Sewer or Drain Backup Endorsement

If the sewer backs up or drains overflow into your home, cleanup and repair can be a nightmare—and it’s not included in most basic policies.

Story: During a summer storm, the Rodriguezes had sewage back up into their bathroom. Gross, right? Their endorsement covered everything from the plumber to the flooring replacement.

🧱 6. Ordinance or Law Coverage

This covers the cost of rebuilding your home to current codes after a covered loss—something your base policy won’t do.

Story: After a kitchen fire, the new building code required the Duponts to update their wiring. Their endorsement paid for the updates, saving them thousands.

💡 7. Replacement Cost Coverage

Standard policies only give you the depreciated value of lost items—so your 5-year-old laptop might only fetch $100. This endorsement makes sure you can replace items at full, new prices.

Story: The Smiths had a break-in. Thanks to this endorsement, they replaced their electronics with new models, not Craigslist leftovers.

🚨 Important Note:

Homeowners insurance does NOT cover flood or rising water. For that, you need a separate flood policy—especially here in South Louisiana. Don’t skip it.

🔍 Let’s Review Your Policy Together

These endorsements don’t cost much—but they can save you thousands. If you live in Metairie or anywhere in Louisiana, let’s make sure your coverage is complete.

📞 Call Molaison Agency at 504-576-0522

We’ll help you level up your policy—so you’re not just covered, you’re confident.